The Cereal City Buzz

Archives

Mortgage Rates Dip Following Federal Reserve's Recent Rate Cut

SIGN UP FOR OUR NEWSLETTER

Mortgage Rates Dip Following Federal Reserve's Recent Rate Cut |

Homebuyers in Michigan See Slight Relief as Mortgage Rates Edge Lower |

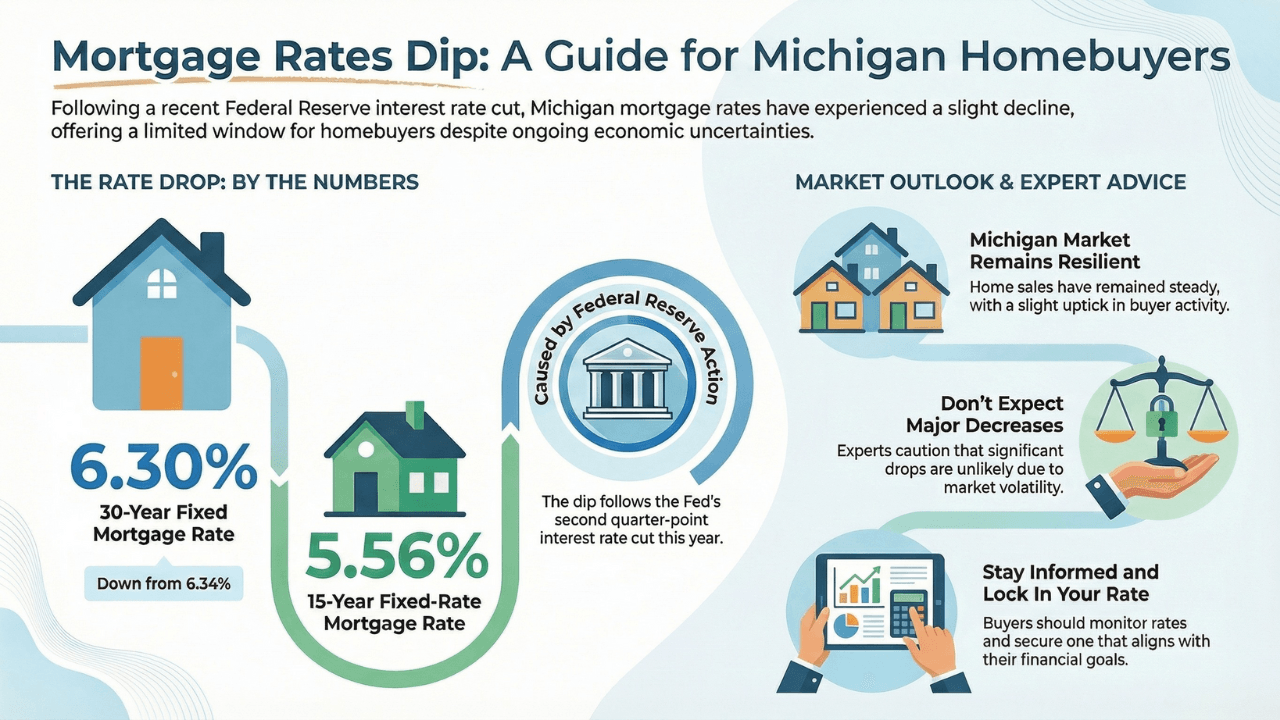

In the wake of the Federal Reserve's latest interest rate reduction, mortgage rates have experienced a modest decline, offering a glimmer of hope to prospective homebuyers in Michigan. The average 30-year fixed mortgage rate has decreased to 6.30%, down from 6.34% the previous week. Similarly, the 15-year fixed-rate mortgage has dipped to 5.56%. ([bankrate.com](https://www.bankrate.com/mortgages/analysis/mortgage-rates-december-17-2025/?utm_source=openai))

This downward trend follows the Federal Reserve's recent quarter-point cut to its benchmark interest rate, marking the second reduction this year. While such cuts aim to stimulate economic activity, their direct impact on mortgage rates can be unpredictable. Historically, mortgage rates don't always mirror the Fed's actions, as they are influenced by various factors, including investor sentiment and economic forecasts. ([apnews.com](https://apnews.com/article/9351815c29cea1e27b531dec88d3e4da?utm_source=openai))

In Michigan, the housing market has shown resilience despite fluctuating mortgage rates. Home sales have remained steady, with a slight uptick in activity as buyers respond to the recent rate adjustments. However, affordability remains a concern, especially for first-time buyers navigating the current economic landscape.

Experts caution that while the recent dip in mortgage rates is encouraging, significant decreases are unlikely in the near future. Economic uncertainties and market volatility continue to play pivotal roles in rate determinations. Prospective buyers are advised to stay informed and consider locking in rates that align with their financial goals.

As the year progresses, the interplay between Federal Reserve policies and mortgage rates will remain a focal point for those looking to enter the housing market. Staying abreast of these developments will be crucial for making informed decisions in the ever-evolving real estate landscape. |