The Cereal City Buzz

Archives

Michigan's Gas Tax Will Increase in 2026: What Drivers Need to Know

SIGN UP FOR OUR NEWSLETTER

Michigan’s Gas Tax Will Increase in 2026. Here’s When You’ll Pay More at the Pump. |

A major overhaul of Michigan's fuel tax system is coming. The changes aim to fix our roads but will impact every driver, especially those with electric and hybrid vehicles. |

Get ready for a major shift at the gas pump across Michigan.

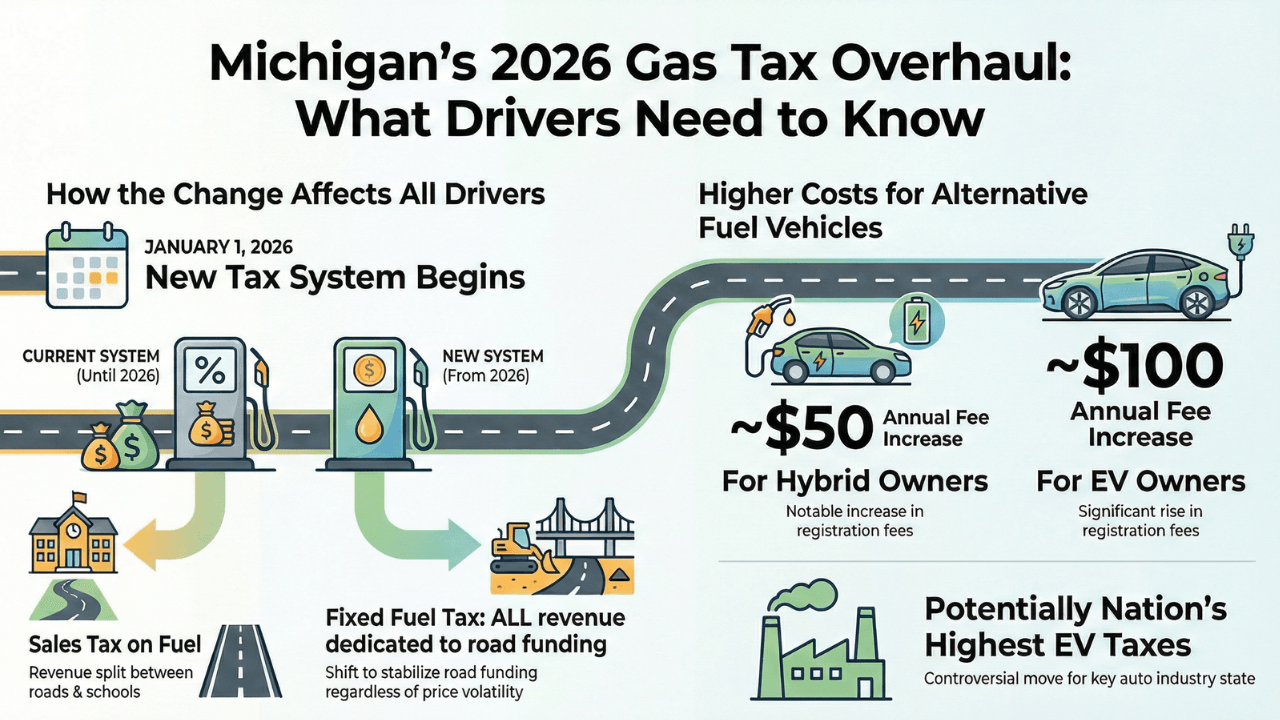

Starting January 1, 2026, Michigan’s gas tax will increase as part of a fundamental restructuring of how the state pays for road maintenance.

This isn't just a simple price hike; it's a complete change in tax philosophy.

Lawmakers in Lansing have decided to eliminate the 6% state sales tax on fuel and replace it with a higher, fixed cents-per-gallon fuel tax.

The goal is to direct all taxes collected at the pump specifically to transportation funding, rather than splitting it with schools and local governments.

This marks a full reversal of the previous tax model.

Under the new system, drivers will pay a more stable tax amount per gallon, regardless of whether gas prices are high or low.

Ironically, this means you may pay relatively more in state tax when fuel prices are down.

Officials have described the move as generally “revenue neutral” for drivers over the long term, but your experience may vary with market volatility.

The change has a particularly sharp impact on owners of alternative fuel vehicles.

Electric vehicle owners could see their annual registration fees increase by an estimated $100.

Hybrid vehicle owners are also facing a potential $50 increase in their yearly fees.

Some critics argue this makes Michigan's EV taxes the highest in the nation, a controversial outcome for a state central to the auto industry's future.

This entire overhaul was included in the state’s massive $81 billion budget, designed to create a more reliable funding stream for Michigan’s notoriously rough roads.

While the goal is improved infrastructure, the immediate effect for every Michigan driver will be a new calculation at the pump come 2026.

FAQ: Michigan Gas Tax Changes

When does Michigan's new gas tax take effect? The new fuel tax structure and corresponding increase will begin on January 1, 2026.

How will the gas tax change in 2026? The state is removing the 6% sales tax on gasoline and replacing it with a higher, fixed cents-per-gallon fuel tax to ensure all revenue funds transportation projects.

Why are EV registration fees going up in Michigan? State law automatically ties EV and hybrid registration fees to the state fuel tax. As the gas tax increases, these fees must also rise to ensure all drivers contribute to road funding. |